Global Hydrogen Demand

1. Overview of global hydrogen demand

In 2023, global hydrogen demand reached 97 million tons, a year-on-year increase of 2.5%. It is expected to be close to 100 million tons in 2024. This growth is mainly due to the increase in global industrial activities, rather than the result of policy support. The demand for hydrogen is still mainly concentrated in refining and industrial applications, which account for the vast majority of hydrogen demand. Emerging application areas such as heavy industry, long-distance transportation and energy storage currently account for less than 1% of global hydrogen demand, although demand in these areas increased by 40% from 2022 to 2023.

2. Demand for low-emission hydrogen

In 2023, the demand for low-emission hydrogen increased by nearly 10%, but the total amount is still less than 1 million tons of global hydrogen demand. The high cost of low-emission hydrogen is the main obstacle to its promotion, which hinders its application in many industries. Policy incentives may be the key to driving demand in the future.

If current policies continue, demand for low-emission hydrogen could grow to 6 million tonnes per year by 2030, although this is still a far cry from the 65 million tonnes required for the 2050 net zero emissions scenario (NZE Scenario).

3. Demand by country

China is the world’s largest hydrogen consumer, with demand approaching 28 million tonnes in 2023 (29% of the global total). The United States follows closely with demand of 13 million tonnes (14% of global demand); the Middle East and India account for 14% and 9% of global demand respectively, with significant growth in demand in the Middle East, especially in refining and methanol production; Europe accounts for 8% of global demand, and other regions account for 24% in total.

4. Demand in transportation

Although the development of hydrogen in the transportation sector is driven by policy support and technological progress, the current demand for hydrogen in the global transportation sector accounts for less than 1% of total demand. From 2022 to 2023, the demand for hydrogen in this sector increased by 40%, mainly concentrated in heavy-duty transport vehicles such as heavy trucks and public transportation.

At present, insufficient hydrogen refueling infrastructure, the manufacturing cost of hydrogen vehicles and the production cost of hydrogen are one of the main reasons why demand in this field cannot grow on a large scale.

It is expected that by 2030, with the advancement of hydrogen energy technology and the increase of policy support, the demand for hydrogen in the transportation field will increase significantly, especially in long-distance freight, shipping and aviation. Hydrogen-based fuels (such as hydrogen, ammonia, methanol) are considered to be an important way to replace traditional fossil fuels.

5. Demand trend

In the next few years, hydrogen demand is expected to gradually shift to low-emission and new application areas, especially in transportation, high-temperature industrial heating and energy storage. Demand in these areas is expected to grow significantly, but it is still relatively low at present.

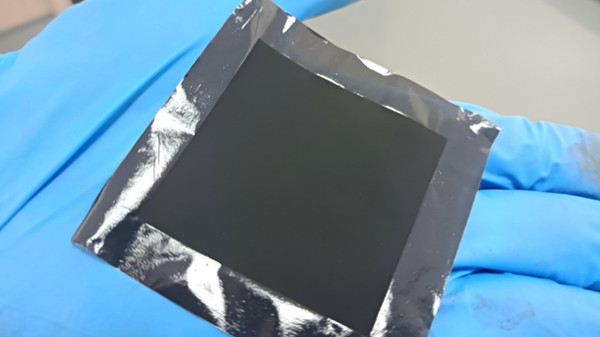

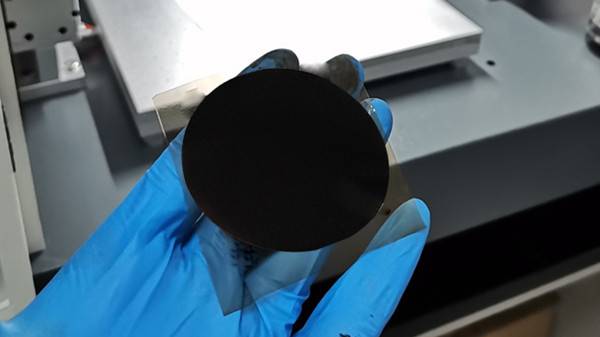

Hydrogen production by electrolysis of water is the most advantageous method for producing hydrogen. Utrasonic coating systems are ideal for spraying carbon-based catalyst inks onto electrolyte membranes used for hydrogen generation. This technology can improve the stability and conversion efficiency of the diaphragm in the electrolytic water hydrogen production device. Cheersonic has extensive expertise coating proton exchange membrane electrolyzers, creating uniform, effective coatings possible for electrolysis applications.

Cheersonic ultrasonic coating systems are used in a number of electrolysis coating applications. The high uniformity of catalyst layers and even dispersion of suspended particles results in very high efficiency electrolyzer coatings, either single or double sided.

About Cheersonic

Cheersonic is the leading developer and manufacturer of ultrasonic coating systems for applying precise, thin film coatings to protect, strengthen or smooth surfaces on parts and components for the microelectronics/electronics, alternative energy, medical and industrial markets, including specialized glass applications in construction and automotive.

Our coating solutions are environmentally-friendly, efficient and highly reliable, and enable dramatic reductions in overspray, savings in raw material, water and energy usage and provide improved process repeatability, transfer efficiency, high uniformity and reduced emissions.

Chinese Website: Cheersonic Provides Professional Coating Solutions